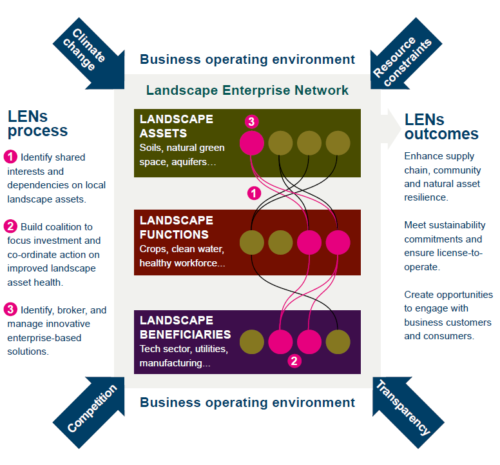

Landscape Enterprise Networks (LENs) links the management of land and landscapes to the long-term needs of business and society (see LENs Explainer). It does this by helping businesses to work together to improve the landscapes in which they operate.

LENs begins by looking at the landscape from the perspective of business need: what are the risks and opportunities that landscapes present to individual businesses? Rather than starting with a top-down plan for the landscape, LENs breaks down complex landscape systems into ‘bite-sized’ transactable chunks. It creates a series of discrete value chains, where small consortia of businesses – brought together around a shared landscape need – are helped to procure the landscape outcomes which matter to their business.

LENs harnesses commercial interest in how landscapes function to drive investment and innovation around strategic assets like soils, aquifers, access infrastructure, and habitats. LENs provides a framework for business collaboration, by identifying shared interests in landscape assets and developing enterprise – based solutions for improving the health of those assets.

Step 1. Network Opportunity Analysis

The LENs process begins with a systematic analysis of three interacting landscape variables: beneficiaries, functions and assets:

- Landscape Beneficiaries. These are the businesses (or other organisations) that have a practical interest in the landscape. These may be in the agrifood sector, but they may also be housing developers, insurance companies, tech businesses or businesses from a wide range of other sectors.

- Landscape Functions. These are the practical outcomes of landscape that beneficiaries are interested in. It includes but goes beyond what is often dealt with as ‘ecosystem services’. It might be the production of foodstuffs, the supply of raw water, the capacity to receive effluent, mitigation of flood risk, improvement of ‘liveability’ for attracting and retaining staff.

- Landscape Assets. These are the features of the landscape system that underpin its ability to deliver the functions required of beneficiaries. These may include soils, watercourses and aquifers, terrestrial habitats, infrastructure for public access and recreation, rural skills and land enterprises.

The goal of this systematic process is to understand which sectors in a region have most at stake as a result of landscape performance, which landscape assets underpin that performance, and where there are cross-overs in interest for different businesses or sectors in the same landscape assets. Importantly, the objective here isn’t about building up a comprehensive picture or plan. It’s about using data, intelligence and insight to identify the most promising place to start building a network.

Step 2. The Basic Operating Unit – a collaborative value chain

This step focuses on building a first ‘anchor’ value chain. The key tasks are shown in the diagram, above. In essence the process involves working with ‘demand side’ interests to define a common specification for services; with the ‘supply side’ to define a service proposition; and then working with both to broker a deal. In our experience the supply side can work best when coordinated through ‘supply aggregators’ (ie farmer clusters, commodity coops, etc), who help land enterprises to work together as a group and create a joined-up proposition.

Step 3. Growing and formalising the regional network

Building a functioning first anchor value chain creates momentum and interest and leads naturally to both extending the first value chain – by attracting more customers and suppliers – and building the next. It is at this point that some form of organisational infrastructure, and governance, is required to manage and broker trades in an equitable, transparent, and locally accountable manner.

Case study – Hampshire Avon LENS

The LENs process was initiated for the Hampshire Avon catchment in early 2018, as part of a project funded by Natural England and requested by the Hampshire Avon Catchment Based Approach (CaBa) group.

An initial scoping into the landscape’s regional economy identified key functions and assets for the Hampshire Avon. 3Keel then used this data to engage with business sectors, and specific beneficiary businesses on whom to conduct an analysis of demand.

We identified three potential opportunities in the Hampshire Avon LENs around the assets of

- effluent capacity;

- soils;

- terrestrial habitats.

The second phase of the project saw an initial network, including Wessex Water, the MOD, and Wiltshire County Council, convened around effluent capacity, in particular in relation to background phosphate levels in the Hampshire Avon catchment. Phosphate is having a significant impact on businesses’ operations, with a particular focus on the upper catchment north of Salisbury.

Perhaps the most commercially significant impact is on the ability of some to gain planning permission for significant commercial and residential developments. Other landscape functions, such as ‘liveability’, reliability of arable supply chains, and flood risk mitigation also figure in the network.

This initial network is now collaborating by using the opportunities identified through the LENs analysis to target their co-investment into effluent capacity in the Hampshire Avon catchment, and procure the required phosphate outcomes from the Pewsey Downs Farmer Group (PDFG).

Photo: Simon Smart